Politicians say we do not have to lose our hope. May be it is the only advice they can offer as they do not have any other solution apart from increasing and increasing public spending. Therefore, we can understand why they highlight any minimum change their watchmen observe in the economic environment. They are signs of hope. Last week we receive information on one of them, that several big banks are starting to make profits. It is a positive news, of course, but we are not very sure that it means the arrival of winds of prosperity.

Looking at more serious economic sources than media (I expect general media will think seriously about their sad role in unanticipating and uncontributing to solve the financial crisis), we discover that the picture is far from communicating a positive message. The economy is performing bad all over the world. Some companies are winning, but most of them are in a very poor position. As the Hudson Institute Economic Report from April 17th points out,

«Although the Reuters/University of Michigan index of consumer sentiment rose to 62 from 57 in March, the economy is by no means out of the woods. Indices of consumer sentiment are notoriously unreliable, since they are based on feelings about the economy, and February data showed a brighter picture of the economy than we see this week».

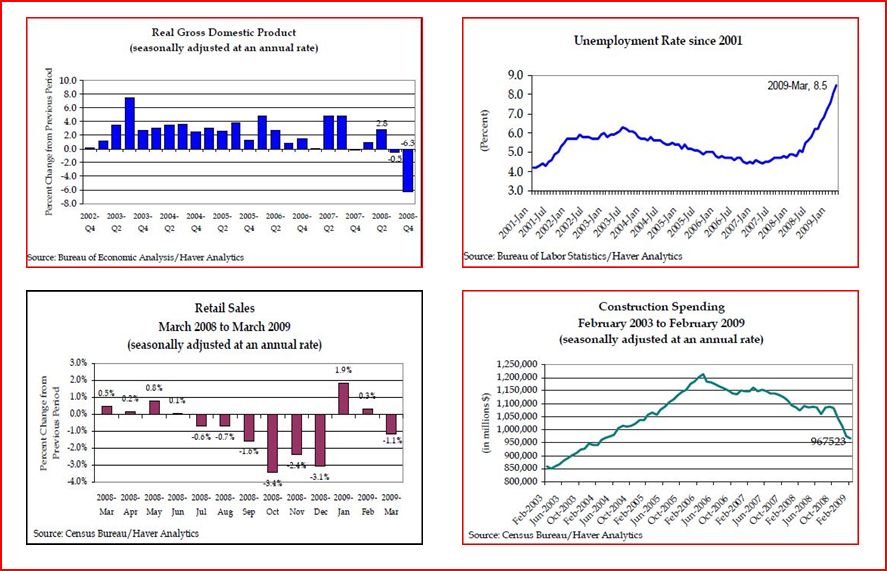

The report analyses several aspects of the economy like housing starts and retail sales. In both cases, data show a continuous decline if we take into account the preceding months. «Housing starts dropped from 572,000 to 510,000 at a seasonally adjusted annual rate. Building permits for future construction decreased by 9.0 percent in March. Retail sales in March fell 1.1% from February sales». The authors also argue that deflation is returning as in March the price fall was of 0,1%. In February, USA had an increase of 0,5 %. For the Hudson Institute, the conclusion is clear:

«In sum, just as one swallow does not a summer make, as the saying goes, March data show that one month’s data—in this case, February’s—do not make an economy recovery.»

Deja una respuesta